Download the full Luxury Goods Aggregate Analytics infographic below.

The Luxury Goods sector has had phenomenal success over the past ten years. Growing global middle classes and readily available credit have paved the way for a social media-driven explosion of demand for high quality brands.

Every major city now has at least one destination street devoted to luxury brand outlets. And with some airports becoming luxury retail malls, and the weekend shopping vacation as a leisure activity in its own right, it is not surprising that projections for this sector have been very optimistic – anything from $500bn to $1.2 trn within 5 years.

What a difference three months makes. GDP is expected to contract by at least 25% in the short term, the stock market is volatile, social distancing is the new normal, international travel is hobbled and the global economy faces protracted mass unemployment.

This is clearly a toxic environment for luxury goods, exacerbated by a huge inventory overhang. The greatest damage comes from shrivelling tourist numbers – expected to cost the industry $80bn. Chinese consumers represent about 25% of all luxury spending and they intend to spend significantly less this year.

Some firms are likely to be resilient; those with strong balance sheets, specialised products and very wealthy customers will weather the worst of the downturn. But the “mass market in luxury” is likely to shrink for some time, leaving the sector ripe for restructuring.

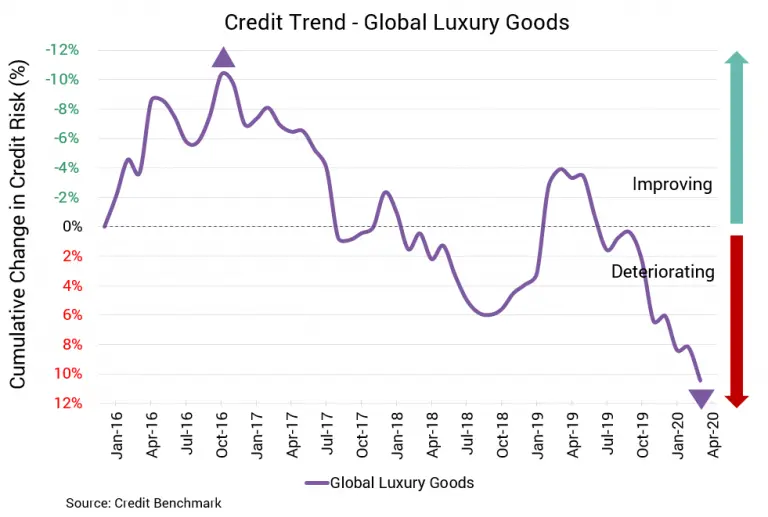

The chart below shows the credit consensus key metrics for 70 companies in this sector.

The majority (more than 80%) of the sample are currently Investment Grade, but the trend is towards downgrades. The net balance of deteriorations vs. improvements has been negative since early 2019, and the latest reading is the largest negative balance in the past few years. Average credit risk has risen by 10% in the past six months and further deterioration in credit quality seems unavoidable.